What is the full effect of having a bankruptcy and my record?

By Tenant

I used to be in a very bad situation because I couldn’t handle my finances very well. The issue is not just because I skipped rent payments but it’s actually worse than that. I had to file for bankruptcy. I just couldn’t take the stress anymore so I had to admit that I didn’t have the money to catch up all my obligations. Well that was a long time ago and I have already re- established my credit score. I tried looking around for an apartment but since landlords do credit checks, that history of bankruptcy always gets pulled up.

So what did I do? I did the following:

- I waited. Records of bankruptcy stayed in your credit history for about 10 years. So that would be ten years of living in apartments that don’t do credit checks. So just imagine what the living conditions would be like and what your neighbors will be like too.

- Since I didn’t want to live in apartment complexes that are not at par with the ones I got used to, I looked for a roommate with good credit history. This is not difficult to as I had friends who really have good credit and would trust me to be their roommate. Of course, to be approved for that apartment it was only my roommate’s name that on the lease. Yet I did my part. I paid my share of the rent promptly and until I was ready to get my own place.

But if you don’t want to do any of these, and I have additional tips for you:

- Contact your lease an agent and ask for the details of the apartment. We also want to know how long back they will pull your credit score. This is very important because some landlords would only full of credit up to five years maximum. So if you file the bankruptcy more than five years ago, then you’re safe.

- In case the bankruptcy shows up, you need to explain to your leasing agent as to why you had to file for it.

- Ask for a month-to-month rental agreement. Some landlords would not feel comfortable trusting you with 12-month agreement however, they may want to give you a chance if you would bring up the possibility of a month-to-month agreement first. If your landlord agrees, you will need to give a deposit and about 1 to 3 months of rent in advance.

- If you can afford it, provide a larger deposit. This will prove to your landlord that you are back on your feet and you can afford to pay the rent.

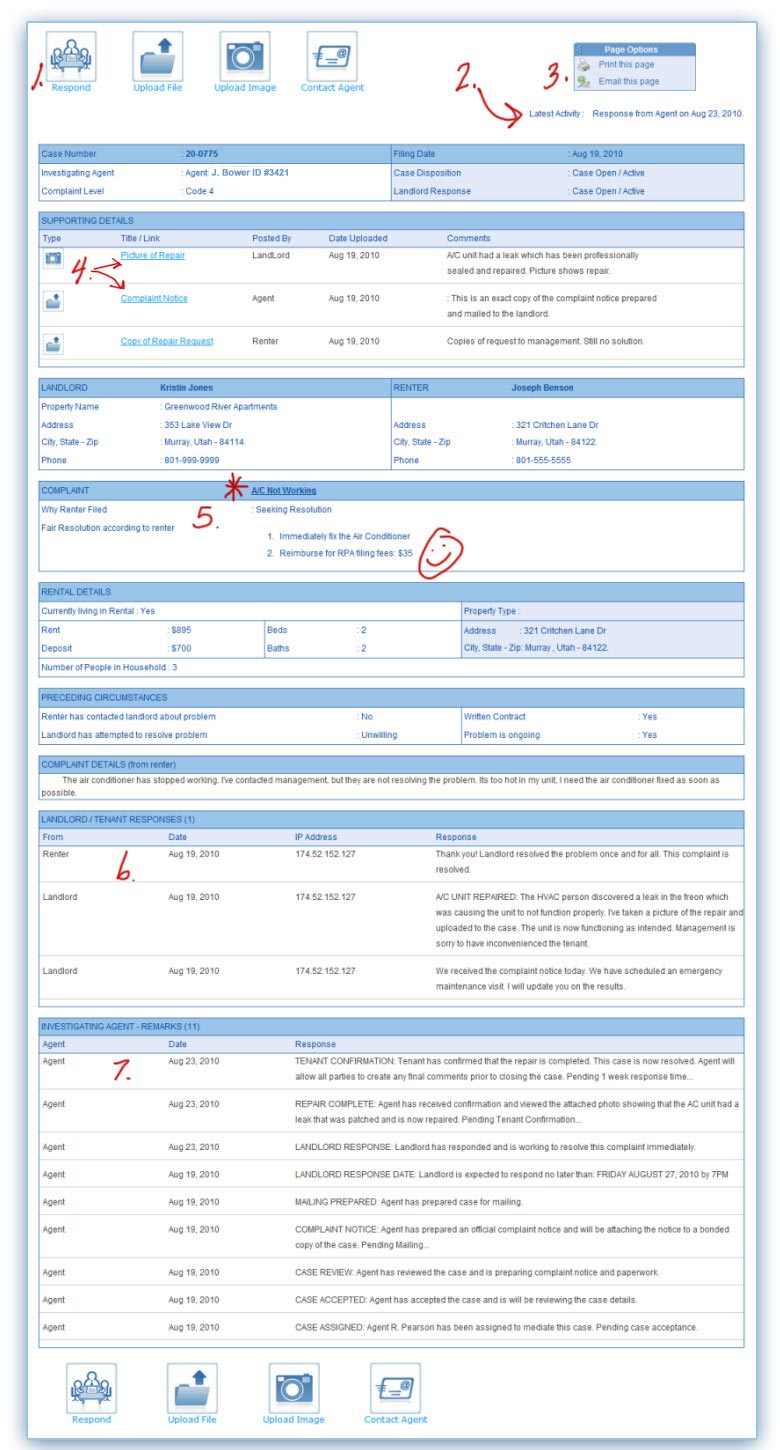

It would also be nice if you can find a privately owned apartment that suits your liking. Chances are privately owned apartments will not run credit checks so you may not need to mention your bankruptcy history. In case you feel discriminated and you were day and night rental, even if the criteria does not include the credit score, then you can file a complaint against that landlord. To file a complaint with the RPA, use this link: http://www.rentalprotectionagency.com/complaint_center.php

Edited on: Thursday, June 6th, 2013 2:27 am

10 Responses to “What is the full effect of having a bankruptcy and my record?”

|

Anonymous February 7th, 2013 1:40 am |

|||

|

I am a landlord and in our case, we require our tenants to have no bankruptcy for at least 5 years back and with everything current – no previous obligations or anything. Yeah, we’re strict but we need to protect our business. |

|||

|

Anonymous February 7th, 2013 10:00 am |

|||

|

When filing for a bankruptcy, you have the option to end your lease agreement, right? But I would suggest you don’t do that. Instead, stay in the apartment, pay your rent on time, build up your credit and wait until the bankruptcy falls off your record. |

|||

|

Anonymous February 7th, 2013 6:00 pm |

|||

|

It is very hard to rent after a bankruptcy but that doesn’t mean it’s impossible to have landlord that would take you in. You just have to be very patient and brave enough to face rejections from like 8 out of 10 landlords. Once you’ve found a place, it is best begin re-establishing a good financial history. Pay your rent on time and do good. Soon your bankruptcy will fall off the record and you should be free to choose the best apartments within your timeframe. |

|||

|

Anonymous February 8th, 2013 2:00 am |

|||

|

Be ready to have money on hand because you are likely to pay more for the deposit. That’s based on my experience. I was even lucky that my landlord didn’t do automated decisioning. Instead, they gather all the records and then they talk to tenants to see if it’s worth the try. However, you will be on a month-to-month basis until your landlords are confident that you are ready to be given the 1-year lease agreement. |

|||

|

Anonymous February 8th, 2013 10:00 am |

|||

|

In Florida, getting a nice apartment after filing for a bankruptcy will be near impossible. Landlords would not let you in so you would have to settle with the last options on the list. And believe me, these are not the places that you would want to live in. I had to spend days just scrubbing the floors, and making sure that everything was spotless. Well, guess what, my landlord still thought the place looked dirty and withheld my deposit. The reason he could do that was because he knew I have bad credit and not so many places would take me in. He has made it very difficult for me to move out. |

|||

|

Anonymous February 8th, 2013 6:20 pm |

|||

|

As a landlord, I don’t rent to anyone who has bankruptcy on their record. Yeah, sure, it may not be their fault why the bankruptcy happened. Things happen and that’s something that you cannot contest. But I’m running a business and I cannot afford to risk on someone who has a bad credit history. |

|||

|

Anonymous February 9th, 2013 2:40 am |

|||

|

Yep, bankruptcy really hurts in Florida. Leave the state and you might get a better deal. |

|||

|

Anonymous February 9th, 2013 11:00 am |

|||

|

I know it’s wrong to judge a person because of credit history but an investment is an investment and it has to be protected. Landlords rely on your rent to pay for the costs of keeping their property, paying the mortgage and even bringing food for their family. So you can’t really blame them if they need to be careful and selective about who they rent to. |

|||

|

Anonymous February 9th, 2013 7:20 pm |

|||

|

This only goes to show that you really have to be careful with how you deal with your finances. If you can’t take the system, move out of country! |

|||

|

Anonymous February 10th, 2013 3:20 am |

|||

|

A landlord creates the rules and requirements as to who can rent their apartment. You, as a tenant, need to make sure that you fit the requirements before you even envision yourself to be living there. A good place needs good credit. If you don’t have one, you just have to wait until the bankruptcy falls of your credit score. Meanwhile, good luck with your neighbors and not-so-nice apartment complex. |

|||

Close

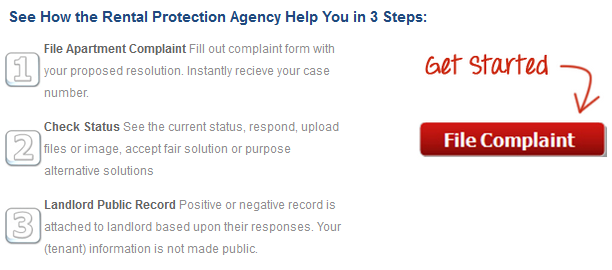

Yes, the RPA® Can Help You!

Filing an official complaint is the nation's fastest way to solve tenant problems.

Not Ready? Learn more...

Need Help Filing Your Complaint?

Agents Available Mon- Fri 10am to 10pm

Recently Resolved Complaints:

See how the Nation's Rental Authority has helped thousands of tenants already!

-

Unsafe Residence; Windows...

Soldotna, Alaska - 99669

Case Number 17-0361

-

Bedbugs And Repairs....

Lancaster, Pennsylvania - 17603

Case Number 23-7321

-

Repair And Discrimination...

Clifton Heights, Pennsylvania - 19018

Case Number 24-2780

-

plumbing leakage...

Mumbai, Alabama - 35005

Case Number 21-7901

-

Lead Paint chipping, majo...

Brattleboro, Vermont - 05301

Case Number 17-0282

Ask Question:

Post a new question to the RPA Tenants rights forum.

You Have Tenant Rights.

Recently Posted Questions:

Over 4,000 questions have been asked by tenants including these new posts:

Tenant Rights Categories

Popular categories about renters rights.

-

- Apartment Complaint (618)

- Frustrated Landlord (21)

- Frustrated Renter (949)

- General Topics (556)

- Landlord humor (2)

- Landlord Legal (25)

- Landlord Problems (846)

- Landlord Q & A (14)

- Landlord Stories (5)

- Landlord Tips (7)

- Legal Questions (1105)

- Rent Horror Stories (192)

- Rent Humor (12)

- Renter Q & A (449)

- Tenant Problems (34)

- Videos Post (109)