Can a tenant file for tax deductions?

By Tenant

Can a person who is renting an apartment apply for tax deductions? Or is it only applicable if you are a landlord? Most tenants ask these questions hoping that somehow they can get a refund every time they file for their tax returns.

Now here is the fact, because a landlord pays most or all the expenses for the up keeping of his rental properties, he can get most or all the corresponding deductions when he file his tax returns. Take this as an example, if there is a required plumbing or repair to be done on the property he usually pays for the work done by the plumber or the repair man and then deducts the expenses he spent when he files for his tax returns. However there are some instances that a tenant pays for some expenses for the property which is typically paid for by the landlord she may be able to deduct the costs she paid in her tax returns.

Nevertheless, a tenant cannot file for a tax deduction if the only thing he is paying is his rent. Currently there is no federal tax deduction for home rentals in the US but there is a federal tax deduction for those who pay the mortgage of their house. This fact is what frustrates most of the tenants and the renters for they cannot use the rent as a means to have a tax refund not like homeowners. Homeowners can file for a tax deduction for their mortgage payments and expenses related to it.

There are states like California and Indiana that have this program that allow tenants that have low income to deduct their rent on their income taxes. Still this law only applies to those renters who have a limited renter’s credits in their state and does not provide any federal tax break.

Edited on: Thursday, March 7th, 2013 11:23 pm

15 Responses to “Can a tenant file for tax deductions?”

|

Anonymous March 8th, 2013 12:20 am |

|||

|

How come there are no federal tax law about this? |

|||

|

Anonymous March 8th, 2013 10:40 am |

|||

|

I think it’s better if I just apply for a house than rent if this is the case. |

|||

|

Anonymous March 8th, 2013 8:40 pm |

|||

|

What a load of crap! |

|||

|

Anonymous March 9th, 2013 6:40 am |

|||

|

This is very unfair! |

|||

|

Anonymous March 9th, 2013 5:00 pm |

|||

|

Only landlords and homeowners can have tax deductions |

|||

|

Anonymous March 10th, 2013 3:20 am |

|||

|

Can I file for tax deductions if I am renting a business? |

|||

|

Anonymous March 10th, 2013 1:20 pm |

|||

|

If I improve the house using my own money still I can’t ask for a tax deduction? |

|||

|

Anonymous March 10th, 2013 11:00 pm |

|||

|

I replaced the house furnace using my money; does that mean I can’t get a refund for it? |

|||

|

Anonymous March 11th, 2013 9:20 am |

|||

|

Is the program only applies on California and Indiana? |

|||

|

Anonymous March 11th, 2013 7:20 pm |

|||

|

Homeowners should not apply for this since we are just the same in a way. We too are paying for the house we are living in. |

|||

|

Anonymous March 12th, 2013 5:20 am |

|||

|

Is it illegal for our landlord to file for a tax deduction for a repair in which he did not exactly pay for? |

|||

|

Anonymous March 12th, 2013 3:40 pm |

|||

|

Can I get a refund for the repairs I paid for? |

|||

|

Anonymous March 13th, 2013 2:00 am |

|||

|

If my landlord can get a refund for his repairs then why is he making a fuss on making repairs to the apartment? |

|||

|

Anonymous March 13th, 2013 12:20 pm |

|||

|

I am a disabled. Can I file for a tax deduction? |

|||

|

Anonymous March 13th, 2013 10:40 pm |

|||

|

This tax deduction sucks! |

|||

Close

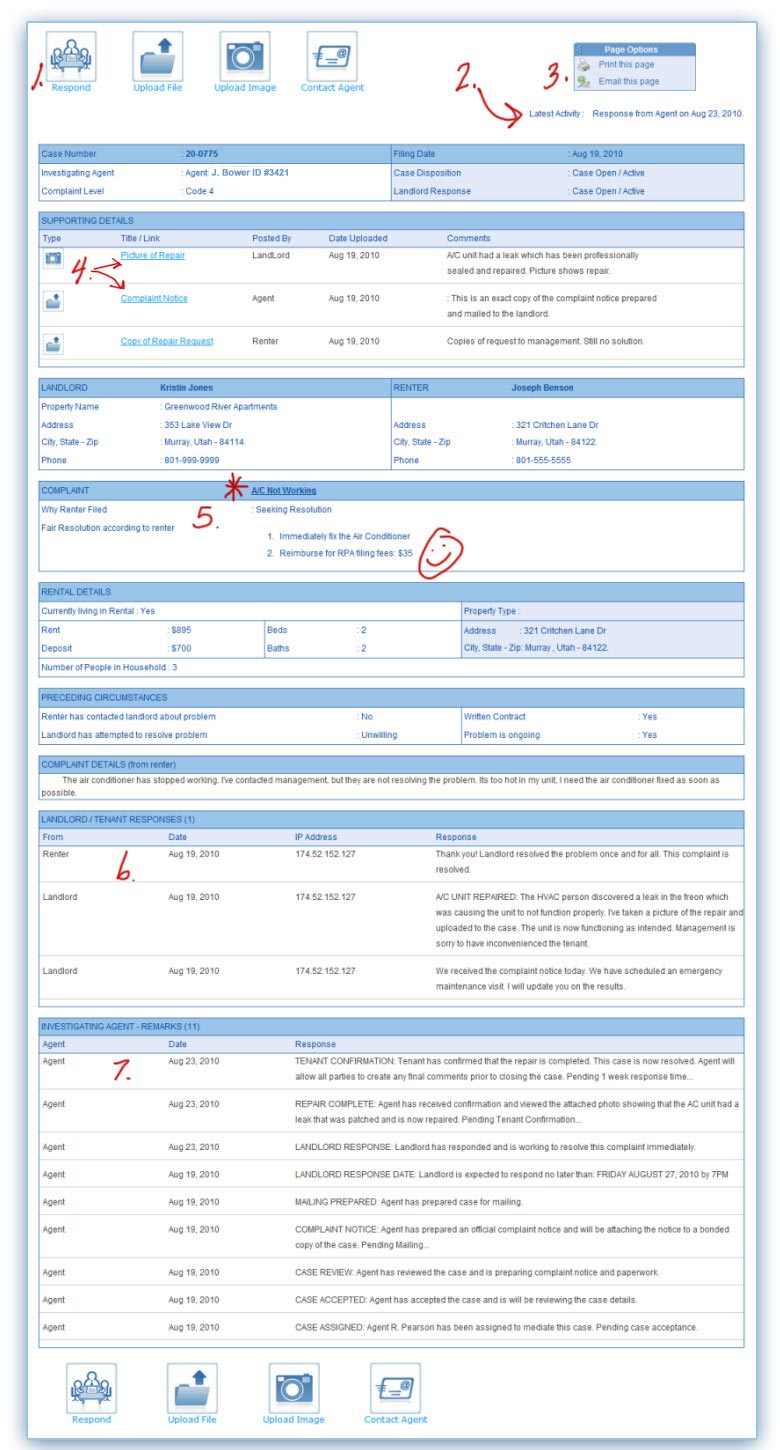

Yes, the RPA® Can Help You!

Filing an official complaint is the nation's fastest way to solve tenant problems.

Not Ready? Learn more...

Need Help Filing Your Complaint?

Agents Available Mon- Fri 10am to 10pm

Recently Resolved Complaints:

See how the Nation's Rental Authority has helped thousands of tenants already!

-

I have bed begs ,i have 2...

St.johnsbury, Vermont - 05819

Case Number 23-2109

-

Repair Issue...

LOS ANGELES, CA - 90020 1312

Case Number 23-1137

-

Deposit Taken For \\...

SAN DIEGO, CA - 92101 2256

Case Number 23-9899

-

Improper Notification Of ...

Greensboro , North Carolina - 27455

Case Number 23-8910

-

Repair Issues...

Mishwaka, Indiana - 46545

Case Number 23-2805

Ask Question:

Post a new question to the RPA Tenants rights forum.

You Have Tenant Rights.

Recently Posted Questions:

Over 4,000 questions have been asked by tenants including these new posts:

Tenant Rights Categories

Popular categories about renters rights.

-

- Apartment Complaint (618)

- Frustrated Landlord (21)

- Frustrated Renter (949)

- General Topics (556)

- Landlord humor (2)

- Landlord Legal (25)

- Landlord Problems (846)

- Landlord Q & A (14)

- Landlord Stories (5)

- Landlord Tips (7)

- Legal Questions (1105)

- Rent Horror Stories (192)

- Rent Humor (12)

- Renter Q & A (449)

- Tenant Problems (34)

- Videos Post (109)